Understanding Uni Tokens: A Comprehensive Guide

Uni Tokens, a revolutionary concept in the world of digital currencies, have been making waves in the blockchain industry. As you delve into this innovative technology, it’s essential to understand its multifaceted nature. In this article, we will explore the various aspects of Uni Tokens, providing you with a detailed insight into their workings, benefits, and potential future developments.

What are Uni Tokens?

Uni Tokens, also known as UNI, are a type of cryptocurrency that operates on the Ethereum blockchain. They were launched by Uniswap, a decentralized exchange platform, in September 2020. The primary purpose of UNI tokens is to facilitate governance and liquidity provision on the Uniswap platform.

How Do Uni Tokens Work?

Uni Tokens operate through a unique governance model that allows token holders to participate in decision-making processes. Here’s a breakdown of how it works:

-

Token Distribution: Initially, 1 billion UNI tokens were distributed to Ethereum users who had participated in the Uniswap liquidity pools. This distribution was done through a snapshot of the Ethereum blockchain.

-

Token Allocation: A portion of the UNI tokens is allocated to liquidity providers, who contribute to the liquidity pools. The remaining tokens are distributed to community members and Uniswap team members.

-

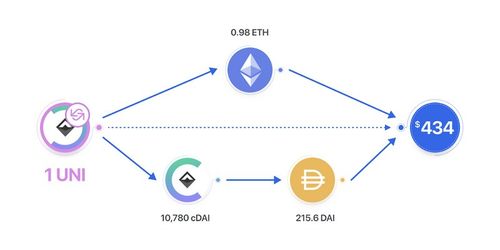

Token Use: UNI tokens can be used for various purposes, including governance, liquidity provision, and participation in the Uniswap ecosystem.

Benefits of Uni Tokens

Uni Tokens offer several benefits to their holders and the broader cryptocurrency community:

-

Decentralized Governance: UNI tokens enable token holders to participate in the governance of the Uniswap platform. This decentralized approach ensures that decisions are made by the community, rather than a centralized authority.

-

Liquidity Incentives: Liquidity providers are incentivized to contribute to the liquidity pools by receiving UNI tokens as rewards. This encourages a healthy and diverse ecosystem of liquidity.

-

Community Involvement: The distribution of UNI tokens to Ethereum users and community members fosters a sense of ownership and involvement in the Uniswap ecosystem.

Uniswap Platform and Uni Tokens

Uniswap is a decentralized exchange platform that facilitates the trading of ERC-20 tokens on the Ethereum blockchain. The platform operates on a unique automated market-making (AMM) model, which allows for seamless and efficient trading without the need for a centralized authority.

Uni Tokens play a crucial role in the Uniswap platform by providing liquidity and governance. Here’s a table summarizing the relationship between Uniswap and Uni Tokens:

| Aspect | Uniswap | Uni Tokens |

|---|---|---|

| Trading Model | Automated Market-Making (AMM) | Facilitates liquidity and governance |

| Token Standard | ERC-20 | ERC-20 |

| Decentralization | Decentralized | Decentralized governance |

Future Developments and Challenges

As the cryptocurrency market continues to evolve, Uni Tokens and the Uniswap platform face several challenges and opportunities:

-

Competition: The decentralized exchange space is becoming increasingly competitive, with new platforms and technologies emerging. Uniswap and Uni Tokens will need to innovate and adapt to maintain their market position.

-

Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving. Uni Tokens and Uniswap will need to navigate these regulations to ensure compliance and continued growth.

-

Scalability: As the Ethereum network continues to grow, scalability remains a challenge. Solutions like layer-2 scaling and alternative blockchains may impact the future of Uni Tokens and Uniswap.

In conclusion, Uni Tokens represent a significant development in the cryptocurrency space. By understanding their workings, benefits, and potential future developments, you can make informed decisions about your involvement in