Apple Federal Credit Union: A Comprehensive Overview

Are you looking for a financial institution that offers a wide range of services and products tailored to meet your needs? Look no further than the Apple Federal Credit Union. This credit union has been serving members for years, providing exceptional service and support. In this article, we will delve into the various aspects of Apple Federal Credit Union, including its history, services, membership, and more.

History of Apple Federal Credit Union

Established in 1966, Apple Federal Credit Union has a rich history of serving the financial needs of its members. The credit union was founded by a group of Apple employees who wanted a financial institution that would offer them competitive rates and personalized service. Over the years, Apple Federal Credit Union has grown significantly, expanding its services and membership base.

Services Offered

Apple Federal Credit Union offers a comprehensive range of services to meet the financial needs of its members. Here are some of the key services provided by the credit union:

-

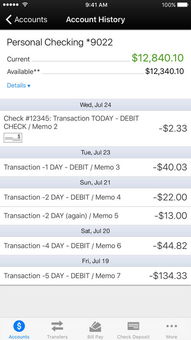

Checking and Savings Accounts: Apple Federal Credit Union offers various checking and savings account options, including free checking accounts with no minimum balance requirements.

-

Loans: The credit union provides personal, auto, and home loans with competitive rates and flexible terms.

-

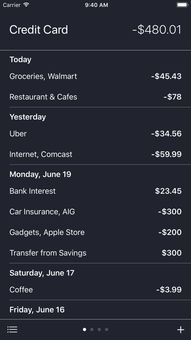

Debit and Credit Cards: Apple Federal Credit Union offers Visa debit and credit cards with rewards programs and fraud protection.

-

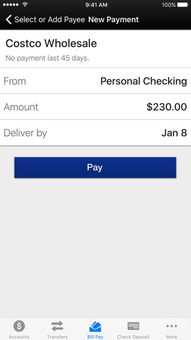

Online and Mobile Banking: Members can access their accounts, make transactions, and manage their finances through the credit union’s online and mobile banking platforms.

-

Investment Services: Apple Federal Credit Union offers investment services, including retirement planning, brokerage accounts, and insurance products.

Membership

Joining Apple Federal Credit Union is simple and straightforward. To become a member, you must meet the following criteria:

-

Be an employee, retiree, or family member of an employee of Apple Inc. or any of its subsidiaries.

-

Be a member of an organization that has a partnership with Apple Federal Credit Union.

-

Live, work, or worship in one of the credit union’s field of membership communities.

Once you become a member, you can enjoy all the benefits and services offered by the credit union.

Community Involvement

Apple Federal Credit Union is committed to giving back to the community. The credit union participates in various community events and initiatives, including financial literacy programs, food drives, and charitable donations. Through these efforts, the credit union aims to make a positive impact on the lives of its members and the communities it serves.

Technology and Innovation

Apple Federal Credit Union is at the forefront of technology and innovation. The credit union continuously invests in new technologies to enhance the member experience. Some of the latest innovations include:

-

Biometric authentication for secure access to online and mobile banking.

-

Real-time fraud monitoring and alerting systems.

-

Robo-advisory services for investment guidance.

Customer Service

Apple Federal Credit Union is known for its exceptional customer service. The credit union has a dedicated team of professionals who are committed to providing personalized assistance and support. Members can contact the credit union through various channels, including phone, email, and in-person visits.

Conclusion

Apple Federal Credit Union is a trusted financial institution that offers a wide range of services and products to meet the needs of its members. With a rich history, a commitment to community involvement, and a focus on technology and innovation, Apple Federal Credit Union is an excellent choice for your financial needs.

| Service | Description |

|---|---|

| Checking Accounts | Free checking accounts with no minimum balance requirements. |

| Savings Accounts | Competitive interest rates and flexible terms. |

| Loans | Personal, auto, and home loans with competitive rates and flexible terms. |