Stake UNI Tokens: A Comprehensive Guide

Are you looking to diversify your cryptocurrency portfolio? Have you heard about UNI tokens and are curious about how to stake them? Staking UNI tokens can be a lucrative venture, offering potential rewards and contributing to the Ethereum network’s decentralization. In this detailed guide, we will explore the ins and outs of staking UNI tokens, covering everything from the basics to advanced strategies.

Understanding UNI Tokens

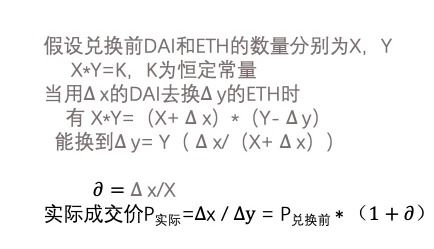

UNI is the native token of Uniswap, a decentralized exchange (DEX) built on the Ethereum blockchain. Launched in September 2020, UNI tokens were distributed to Ethereum holders as a reward for their participation in the network. Since then, UNI has gained significant traction, becoming one of the most popular tokens in the DeFi space.

As a governance token, UNI holders can vote on critical decisions affecting the Uniswap protocol, such as fee changes, liquidity mining programs, and future integrations. This unique governance model has contributed to UNI’s growing popularity and value.

What is Staking?

Staking is a process where you lock up your tokens in a smart contract to support a network or protocol. In return, you receive rewards in the form of additional tokens or interest. Staking UNI tokens allows you to earn more UNI tokens while contributing to the Ethereum network’s security and decentralization.

How to Stake UNI Tokens

Staking UNI tokens is relatively straightforward, but there are a few steps you need to follow:

-

Acquire UNI tokens: You can purchase UNI tokens on various exchanges, such as Binance, Coinbase Pro, and Kraken.

-

Choose a staking platform: There are several platforms where you can stake UNI tokens, including MyEtherWallet, Ledger Live, and Uniswap.

-

Connect your wallet: Use your Ethereum wallet to connect to the staking platform. Ensure your wallet has enough ETH to cover transaction fees.

-

Lock your UNI tokens: Once connected, you can lock your UNI tokens in the smart contract. The duration of the lock can vary, with some platforms offering flexible lock periods.

-

Start earning rewards: After locking your tokens, you will begin earning rewards in the form of additional UNI tokens.

Benefits of Staking UNI Tokens

Staking UNI tokens offers several benefits, including:

-

Reward earnings: Staking UNI tokens allows you to earn additional UNI tokens, which can be a significant source of income.

-

Participation in governance: As a UNI token holder, you can participate in the governance of the Uniswap protocol, influencing its future development.

-

Supporting the Ethereum network: Staking UNI tokens helps to secure the Ethereum network and ensure its decentralization.

Risks of Staking UNI Tokens

While staking UNI tokens offers numerous benefits, it’s essential to be aware of the risks involved:

-

Market volatility: The value of UNI tokens can be highly volatile, which can affect your rewards and the amount of UNI tokens you receive.

-

Smart contract risks: Staking involves interacting with smart contracts, which can be vulnerable to bugs or attacks.

-

Lock-up period: Once you lock your UNI tokens, you won’t be able to access them until the lock-up period ends, which can be risky if the market takes a downturn.

Staking UNI Tokens vs. Other Tokens

When comparing staking UNI tokens to other tokens, there are a few factors to consider:

| Token | Staking Platform | Reward Earnings | Lock-up Period |

|---|---|---|---|

| UNI | MyEtherWallet, Ledger Live, Uniswap | Additional UNI tokens | Flexible lock periods available |