ATM in the United States: A Comprehensive Guide

When it comes to accessing cash in the United States, ATMs play a crucial role. These automated teller machines are widely available and offer a convenient way to withdraw money, check account balances, and perform various financial transactions. In this article, we will delve into the different aspects of ATMs in the United States, including their history, types, fees, and usage statistics.

History of ATMs in the United States

The concept of an ATM was first introduced in the United States in 1967 by Bank of America. The first ATM was installed at a branch in San Francisco. Since then, the number of ATMs has grown exponentially, with millions of machines now available across the country.

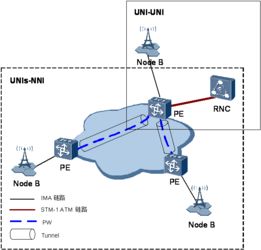

Types of ATMs in the United States

ATMs in the United States can be categorized into several types based on their functionality and location:

-

Bank-owned ATMs: These ATMs are operated by banks and are typically found within their branches or at partner locations.

-

Independent ATMs: These ATMs are owned and operated by third-party companies and can be found in various locations, such as convenience stores, gas stations, and shopping malls.

-

Co-branded ATMs: These ATMs are a partnership between banks and third-party companies, offering services from both entities.

-

ATMs in foreign countries: While not located in the United States, these ATMs are important for travelers looking to access cash while abroad.

ATM Fees in the United States

ATM fees can vary depending on the type of ATM and the bank or financial institution. Here are some common types of fees:

| Fee Type | Description |

|---|---|

| Foreign Transaction Fee | Charged when using an ATM outside of your home country. |

| Non-Bank ATM Fee | Charged when using an ATM that is not owned by your bank. |

| Surcharge Fee | Charged by the ATM owner for using their machine. |

It’s important to note that some banks offer fee-free ATM access at partner institutions, while others may charge a fee for using non-bank ATMs.

Usage Statistics of ATMs in the United States

According to the Federal Reserve, there were approximately 425,000 ATMs in the United States as of 2020. Here are some interesting statistics regarding ATM usage:

-

On average, Americans withdraw approximately $2.5 billion from ATMs each day.

-

ATM withdrawals account for about 40% of all cash withdrawals in the United States.

-

Approximately 70% of Americans have used an ATM within the past month.

Security and Safety of ATMs in the United States

ATMs in the United States are generally safe to use, but it’s important to be aware of potential risks:

-

Skimming: Criminals can use skimming devices to steal your card information when you insert it into an ATM.

-

Card trapping: Criminals can insert a device into the card slot to trap your card and prevent you from retrieving it.

-

ATM robbery: While rare, ATMs can be targeted by robbers.

Here are some tips to help you stay safe when using an ATM:

-

Always use ATMs located in well-lit, secure areas.

-

Be aware of your surroundings and avoid using ATMs in isolated or suspicious locations.

-

Never leave your card in the ATM or write down your PIN.

-

Report any suspicious activity to your bank immediately.

Conclusion

ATMs in the United States have become an integral part of our daily lives