Understanding MSCI Uni: A Comprehensive Guide

Are you curious about MSCI Uni and how it can impact your investment decisions? Look no further! In this detailed guide, we’ll explore the various aspects of MSCI Uni, including its history, features, and benefits. By the end of this article, you’ll have a clearer understanding of what MSCI Uni is all about and how it can help you make informed investment choices.

What is MSCI Uni?

MSCI Uni, also known as MSCI Universal, is a global equity index that provides a comprehensive view of the world’s equity markets. It is designed to offer investors a broad and diversified exposure to the global equity universe, covering approximately 99% of the investable global equity market capitalization.

History of MSCI Uni

MSCI, or Morgan Stanley Capital International, was founded in 1969 and has since become a leading provider of financial information and investment solutions. The MSCI Uni index was introduced in 2018 as an expansion of the MSCI ACWI (All Country World Index), which covers approximately 85% of the global equity market capitalization.

Features of MSCI Uni

Here are some key features of MSCI Uni:

| Feature | Description |

|---|---|

| Global Coverage | MSCI Uni covers approximately 99% of the global equity market capitalization, providing a comprehensive view of the global equity universe. |

| Market Capitalization Weighting | The index is market capitalization weighted, meaning that larger companies have a greater influence on the index’s performance. |

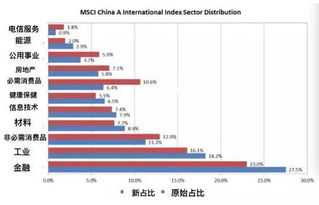

| Country and Sector Diversification | MSCI Uni provides exposure to a wide range of countries and sectors, helping investors diversify their portfolios. |

| Historical Performance | MSCI Uni has demonstrated strong historical performance, making it an attractive option for investors seeking long-term growth. |

Benefits of MSCI Uni

Investors can benefit from MSCI Uni in several ways:

-

Comprehensive Global Exposure: MSCI Uni provides access to a wide range of global equity markets, allowing investors to diversify their portfolios and reduce risk.

-

Market Capitalization Weighting: The index’s market capitalization weighting ensures that larger companies, which often have greater market influence, have a greater impact on the index’s performance.

-

Historical Performance: MSCI Uni has demonstrated strong historical performance, making it an attractive option for investors seeking long-term growth.

-

Transparency and Reliability: MSCI is a well-respected and trusted provider of financial information, ensuring that the index is transparent and reliable.

How to Invest in MSCI Uni

Investors can invest in MSCI Uni through various investment vehicles, such as exchange-traded funds (ETFs) and mutual funds. Here are some popular options:

-

MSCI ACWI IMI Index Fund: This ETF tracks the MSCI ACWI IMI Index, which is a sub-index of MSCI Uni.

-

BlackRock Global Equity Fund: This mutual fund invests in a diversified portfolio of global equities, including those included in MSCI Uni.

-

Vanguard Total World Stock ETF: This ETF provides exposure to a broad range of global equities, including those included in MSCI Uni.

Conclusion

MSCI Uni is a powerful tool for investors seeking a comprehensive and diversified exposure to the global equity market. With its broad coverage, market capitalization weighting, and strong historical performance, MSCI Uni can be an attractive option for investors looking to grow their wealth over the long term. By understanding the features and benefits of MSCI Uni, you can make informed investment decisions and potentially achieve your financial goals.