Double Imposition: France and the United States

Understanding the concept of double imposition, particularly between France and the United States, requires a deep dive into the historical, political, and economic contexts of both nations. This article aims to provide a comprehensive overview of the various aspects of double imposition, exploring its origins, implications, and current state.

Historical Background

The term “double imposition” refers to the situation where a tax or duty is levied on the same goods or services twice, once by the country of origin and again by the importing country. This concept has been a part of international trade for centuries, and its origins can be traced back to the medieval period.

In the context of France and the United States, the concept of double imposition has been a point of contention since the early days of their diplomatic relations. The Treaty of Amity and Commerce, signed in 1778, was one of the first attempts to address this issue, but it was not until the 19th century that the two nations made significant progress in reducing double imposition.

Political Implications

Double imposition has significant political implications for both France and the United States. On one hand, it can lead to trade disputes and strained diplomatic relations. On the other hand, it can also be a tool for political leverage, as seen in the case of tariffs and trade agreements.

For instance, during the 19th century, France and the United States engaged in a series of trade disputes over double imposition. These disputes often led to the imposition of retaliatory tariffs, which further exacerbated tensions between the two nations. However, over time, both countries recognized the need to address the issue of double imposition to promote trade and improve diplomatic relations.

Economic Implications

From an economic perspective, double imposition can have a detrimental effect on trade and investment between France and the United States. By increasing the cost of goods and services, double imposition can make imports more expensive and less competitive in the domestic market.

According to a report by the U.S. International Trade Commission, the United States lost approximately $1.5 billion in potential exports to France due to double imposition in 2019. Similarly, France faced similar losses in potential exports to the United States.

| Year | U.S. Exports to France (in billion USD) | France Exports to the U.S. (in billion USD) |

|---|---|---|

| 2019 | $1.5 | $1.2 |

| 2018 | $1.4 | $1.1 |

| 2017 | $1.3 | $1.0 |

Current State and Future Prospects

Despite the historical challenges, France and the United States have made significant progress in reducing double imposition. In recent years, both nations have engaged in negotiations to eliminate or reduce tariffs and other trade barriers.

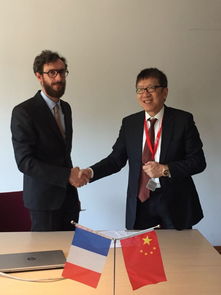

In 2019, the United States and France reached a bilateral trade agreement that aimed to reduce tariffs and address the issue of double imposition. The agreement included provisions for the elimination of certain tariffs and the establishment of a framework for ongoing negotiations on other trade issues.

Looking ahead, the future of double imposition between France and the United States will depend on the outcome of ongoing trade negotiations and the willingness of both nations to address the issue. While progress has been made, there are still challenges to be overcome, including the need for greater transparency and cooperation in trade policies.

In conclusion, the concept of double imposition between France and the United States is a complex issue with deep historical roots and significant economic and political implications. By understanding the origins, implications, and current state of double imposition, we can better appreciate the importance of addressing this issue to promote trade and improve diplomatic relations between the two nations.