Arrowhead Credit Union: A Comprehensive Overview

Are you looking for a financial institution that not only offers traditional banking services but also goes the extra mile to cater to your unique needs? Look no further than Arrowhead Credit Union. This financial cooperative is dedicated to providing its members with exceptional service, competitive rates, and a wide range of financial products. In this article, we will delve into the various aspects of Arrowhead Credit Union, including its history, services, membership benefits, and community involvement.

History and Background

Established in 1952, Arrowhead Credit Union has a rich history of serving the financial needs of its members. Initially, it started with a small group of employees from the Arrowhead Park Hospital in Glendale, Arizona. Over the years, the credit union has grown significantly, now serving thousands of members across the state. Its commitment to community and member satisfaction has remained unwavering, making it a trusted financial partner for many.

Services Offered

Arrowhead Credit Union offers a comprehensive range of financial services to cater to the diverse needs of its members. Here are some of the key services provided:

-

Checking and Savings Accounts: With various account options, members can choose the one that best suits their financial goals.

-

Loans: From personal loans to auto loans, Arrowhead Credit Union has a variety of loan options to help members achieve their financial objectives.

-

Home Equity Loans: Members can tap into the equity in their homes to finance home improvements, debt consolidation, or other expenses.

-

Debit and Credit Cards: With competitive rates and rewards programs, members can enjoy the convenience and benefits of using Arrowhead Credit Union’s cards.

-

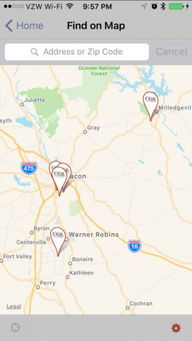

Online and Mobile Banking: Members can access their accounts, make transactions, and manage their finances anytime, anywhere.

-

Investment Services: Arrowhead Credit Union offers investment options to help members grow their savings and achieve long-term financial goals.

Membership Benefits

Being a member of Arrowhead Credit Union comes with numerous benefits. Here are some of the key advantages:

-

Competitive Interest Rates: Members enjoy competitive interest rates on savings, loans, and certificates of deposit.

-

No Minimum Balance Requirements: Arrowhead Credit Union does not require a minimum balance to maintain an account, allowing members to keep their money accessible.

-

Free Checking: Members can enjoy free checking with no monthly fees or minimum balance requirements.

-

Low Loan Rates: Arrowhead Credit Union offers low-interest rates on loans, helping members save money on borrowing costs.

-

Member Discounts: Members can take advantage of exclusive discounts on various products and services offered by Arrowhead Credit Union’s partners.

Community Involvement

Arrowhead Credit Union is deeply committed to the communities it serves. The credit union actively participates in various community initiatives and supports local organizations. Here are some of the ways Arrowhead Credit Union contributes to the community:

-

Financial Literacy Programs: Arrowhead Credit Union offers financial literacy workshops and resources to help members improve their financial knowledge and skills.

-

Charitable Contributions: The credit union donates to local charities and organizations, supporting causes that matter to its members.

-

Volunteer Opportunities: Arrowhead Credit Union encourages its employees to volunteer in the community, fostering a culture of giving back.

Conclusion

Arrowhead Credit Union stands out as a reliable and customer-centric financial institution. With its extensive range of services, competitive rates, and commitment to community, it has become a preferred choice for many individuals and families. Whether you are looking for a checking account, a loan, or investment opportunities, Arrowhead Credit Union has got you covered. Join the Arrowhead Credit Union family and experience the difference of a financial cooperative that truly cares about its members.

| Service | Description |

|---|---|

| Checking and Savings Accounts | Various account options to suit your financial goals. |

| Loans |